We are delighted to welcome Noah Helman, PhD, as our guest blogger. Noah, who is Founder & President of California-based Industrial Microbes, will be contributing to Knowtion this month by exploring why he believes that biocatalytic conversion of waste-derived C1 feedstocks will be a key component of the Circular Economy.

***

Summary: The nexus of four forces is reshaping the playing field for a decarbonized chemicals industry. The ‘electrification of everything’ movement will decrease oil demand while at the same time a growing global economy will increase demand for chemicals. The COVID-19 pandemic exposed the fragility of our globalized supply chains and the war in Ukraine highlighted the dangers of relying on importing energy and key raw materials. The political winds have shifted substantially towards fighting climate change, with the passage of the Inflation Reduction Act in the US and the Carbon Border Adjustment Tax in the EU. Taken together, the widespread restructuring of the chemicals and materials industry towards a circular economy is poised for a massive trillion-dollar economic opportunity that can capitalize on cheap electricity in the context of these four forces.

The all-in cost of building and operating solar and wind farms has dropped below the cost of just operating existing coal-fired power plants, which are being pushed into extinction. Electric vehicles are winning on performance first: They are quiet, exhaust-free, low-maintenance, and fun to drive. By 2030, and perhaps sooner, they will be much less expensive to own than gas-burning cars. Building heating and cooling will soon be cheaper when supplied by heat pumps, which will take advantage of low-cost electricity generation and which do not release asthma-causing combustion byproducts into our homes.

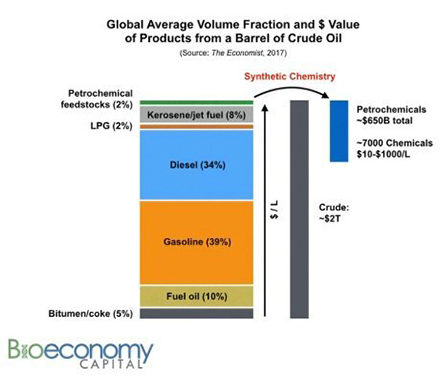

In 2019, Rob Carlson, Managing Partner of Bioeconomy Capital, saw these trends emerging and played out the implications for the petrochemicals industry in his article Seeing The End of Oil. He concluded that the widespread adoption of electric vehicles and cheap renewable electricity would kill the economics of the oil industry. And it would drag the petrochemicals industry down with it, because chemicals, gasoline, fuel oil, and diesel all come from the same barrel of oil.

The key observation is that petrochemicals are made from molecules that comprise a small fraction of the barrel (~2%), but it’s impossible to selectively suck those molecules out of the ground. You have to extract and separate the petrochemical feedstock molecules from the other 98% of the barrel. Once cars and homes run on cheaper renewable electricity, demand for most of the barrel will drop dramatically, and the economics of oil extraction and refining will no longer make sense. Even the oil major BP is projecting that oil probably already peaked in 2019. Our internal analysis indicates that by 2030, petrochemical prices will increase significantly from today’s 2023 prices, in some cases by as much as 2-fold.

Four Major Forces Have Aligned to Replace Oil with Renewables

Force #1: Low-Cost Electricity and Electric Vehicles are Taking Over

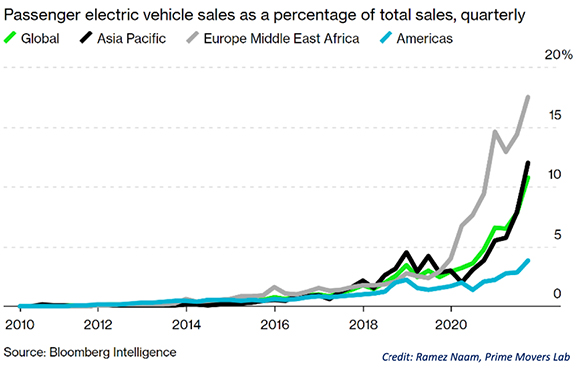

Just three years later, Rob’s predictions are already coming true. Today, in 2023, solar PV and wind turbines are winning on cost, and installations are rate-limited by their supply chains. Adoption of electric vehicles has had its ‘hockey stick’ moment, due to a perfect storm of consumer preferences, concerns about climate change, high gasoline prices, and government action, such as California announcing a ban on sale of new internal combustion engine cars after 2035.

Between 2019 and 2022, there were three unexpected major developments that almost nobody saw coming.

Force #2: COVID-19 Revealed the Value of Local Supply Chains

The COVID-19 pandemic severely disrupted almost every aspect of life around the world, especially global trade and supply chains. As different countries established their own rules around travel and import/export, the flow of raw materials and goods became unbalanced and certain industries ground to a halt. There was a brief period where the price of oil went negative for the first time in history. Store shelves frequently ran out of an unpredictable mix of items. Though few people had previously heard the expression ‘supply chain’ before COVID, by late 2020 it was all over the news.

COVID caused people to realize the value of local supply chains and the dangers of economic globalization in times of crisis.

Force #3: Local, Distributed Renewable Energy Production Provides National Security

Russia invaded Ukraine in February 2022 and as 2023 begins, Russia continues to attack key infrastructure, leaving many Ukrainians without power or heat during the long winter.

Russia’s behavior sparked a backlash in the West and both sides have wielded energy as a weapon. Europe and the US stopped buying Russian oil to apply economic pressure to the Kremlin. A giant hole appeared in the Nord Stream natural gas pipeline, apparently due to sabotage, and an astronomical amount of methane was released directly to the atmosphere (the largest single methane emission ever recorded). Prices of energy in Europe exploded off the charts, while gasoline in California topped $7 per gallon.

In Europe especially, energy dependence on Russian oil and gas is obviously a huge liability, which has created a powerful incentive to switch to renewables as fast as possible. National security now requires energy security and renewable sources like wind, solar, and geothermal are inherently local. The intersection of climate change, economics, and national security aligned people across the spectrum. In addition to sending arms and money to Ukraine, climate activists began calling on the US government to send a million heat pumps to Europe.

For more than 100 years dating back to WWI, access to oil has played a major role in global geopolitics. In a profound change, every country now must look at the combination of renewable electricity, EVs, and heat pumps as the new cornerstone of national security policy.

Force #4: The Political Momentum Shifted Towards Fighting Climate Change

Speaking of government policy, the political landscape on climate change has shifted beyond a tipping point. According to Pew Research, the public’s concern for the issues around climate change are at all-time highs. In several countries such as France, Japan, and South Korea, more than 80% of respondents reported feeling that global warming was a “major threat” to their country.

The US government passed the Inflation Reduction Act (IRA), with wide-ranging provisions aimed at fighting climate change. This law offers tax credits for EVs partially made in the US, in order to support the domestic manufacturing industry. By creating the right economic incentives, these policies further align climate goals and national security with the interests of labor. The IRA’s architects broadly covered the spectrum of clean technologies with a heavy sprinkling of tax credits. As a result, the news is frequently covering announcements of new lithium-ion battery factories, EV assembly plants, and solar farms. Without question, it’s the most significant climate legislation in US history.

Meanwhile, Europe is putting together a Green Deal and a border adjustment tax. However, Europe begins its Energy Transition from a different strategic location. Reliant on oil sources outside of the continent, post-war Europe built up a significant petrochemical manufacturing industry. But, much of that installed capacity is coming to the end of its useful life.

The chemical companies that need to replace this equipment are looking at a 20-year commitment or longer. With the strong momentum towards cleaner technologies and the public’s support for stronger climate-focused regulations, these chemical companies may not want to risk investing in a new petrochemical plant in Europe. But they may also worry about the risk of building new greener technologies, especially if they come online while the legacy (“dirty”) product is being made at low-cost elsewhere and imported into Europe as competition. The genius of the carbon border adjustment tax is its ability to tilt the playing field in favor of cleaner technologies, without having to achieve a global consensus on carbon emissions taxation.

One might even imagine a virtuous cycle by setting up a kind of ‘Green Arms Race’ with the EU, US, and China competing over manufacturing dominance in climate-tech.

Tailwinds for Fighting Climate Change and Building a Sustainable Economy

Taken together, the Clean Energy Transition is accelerating both the shift to low-carbon energy and the de-globalization of greener supply chains. This shift is driven by economics, domestic job creation, national security concerns, and a high level of public anxiety that has begun to influence voting and purchasing preferences.

Many of the technologies needed to transform our society into the Age of Sustainability are already proven at scale: wind turbines, solar photovoltaics, heat pumps, lithium-ion batteries, and cost-competitive electric vehicles. The challenge for the electrification of transportation, buildings, and the grid will be the speed of deployment.

The technologies needed for sustainable materials, on the other hand, are still being developed. In fact, as we’ll discuss in the next article, these key inventions will take advantage of low cost electricity by using biological catalysts rather than chemical catalysts. In other words, the path to electrification of the Circular Economy of the future will be via biocatalysis.

Recent Comments