Contributing Editors: J. Boen and A. Breckenridge

Consumer demands for sustainability driven by value, innovation and a better way of life.

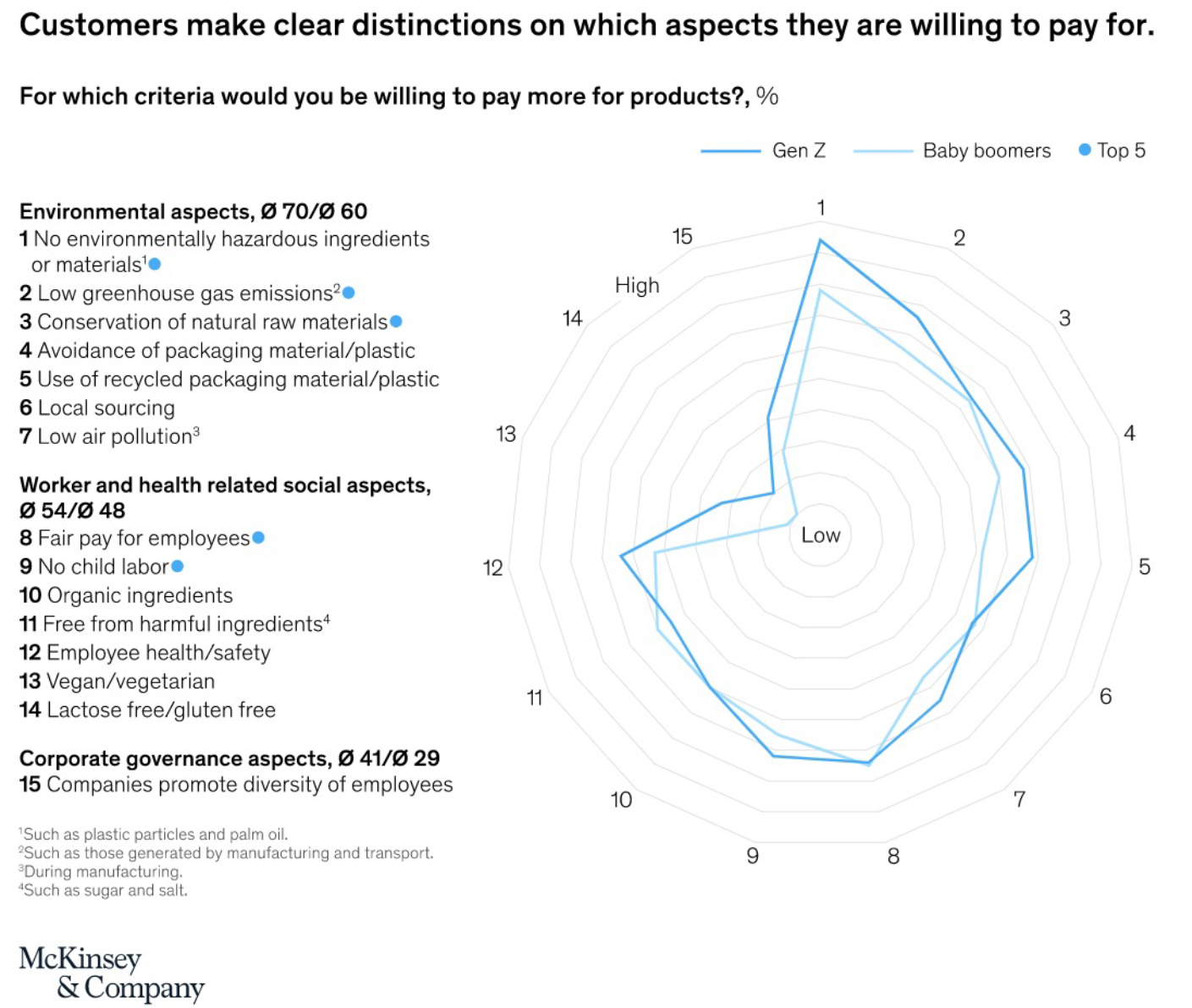

Throughout human history, consumer demand for value and convenience has always been the essential driver for innovation adoption. Over the last two decades, consumer awareness and preference for goods that are sustainably made has steadily increased. Now, we’re beginning to see buyers demand prices to support sustainability focused products. In early 2022, First Insight published a report¹ where they noted that two-thirds of consumers are willing to pay more for sustainable products. But in my opinion to obtain full scale adoption pricing must become competitive. Furthermore, McKinsey published an EU consumer report² where they established clear distinctions on what aspects of sustainability increase consumers’ willingness to pay a premium (see chart below). Social, economic, and environmental sustainability are top of mind for consumers. Climate goals³ have especially influenced consumers to be increasingly cognizant of the environmental implications to their purchasing habits and contribute where they can make an impact on the economy’s push to a more sustainable future. This is a strong indication that future demands from consumers for sustainable products will continue to grow. Companies like Perfect Day, Arcaea, and Visolis are a few examples of industrial biology companies positioning themselves to support consumers’ desires for sustainable products.

Over the last twenty years, we’ve not only seen consumer interest evolve, but also the capabilities of the technologies underpinning many of the pivotal companies we discussed in our last blog. Decreasing costs of genome sequencing and computation have given industrial biology companies the opportunity to quickly implement design-build-test-learn (DBTL) cycles into their R&D efforts. This, along with years of trial and error have led to companies who’ve harnessed the ability to engineer microbes and enzymes that are capable of producing products at scale reliably and with favorable economics. For example, in 2016 Geno published a paper⁴ on its bioengineering platform that it used to optimize 1,4-butanediol production in microbes. The paper displays the engineering process needed to obtain the desired chemical and how as they made the process more efficient, the company was able to decrease costs. Since publishing this paper, Geno has announced that its 1,4-butanediol is now cheaper than its petrochemical-derived counterparts – noting that the costs will actually continue to decrease overtime. In cell-free processes that use engineered enzymes instead of whole organisms, Solugen has been leading the way. Like Geno, Solugen employs a DBTL cycle for both its enzymes and metal catalysts that enables its enzymes to efficiently produce more than 10,000 tons/year of specialty chemicals at its carbon-negative plant in Houston.

Bioinformatics and computational biology will remain strong tools for expanding knowledge and solidifying confidence in smaller datasets produced by industrial biology companies. Evolution of these tools will enable better data-driven decision making for R&D teams in the near term. Expect integration of software like artificial intelligence (AI) and machine learning (ML) to become prevalent as larger datasets become available to feed into these processes. Use of these approaches will allow companies to substantially decrease time-to-market and increase the efficacy of their microscopic bio-factories. Continued collaboration between computational analytics and biological engineering will result in fast, efficient, and economical development of bioproducts that can overtake incumbents.

Bioproducts reaching cost parity and continue to improve

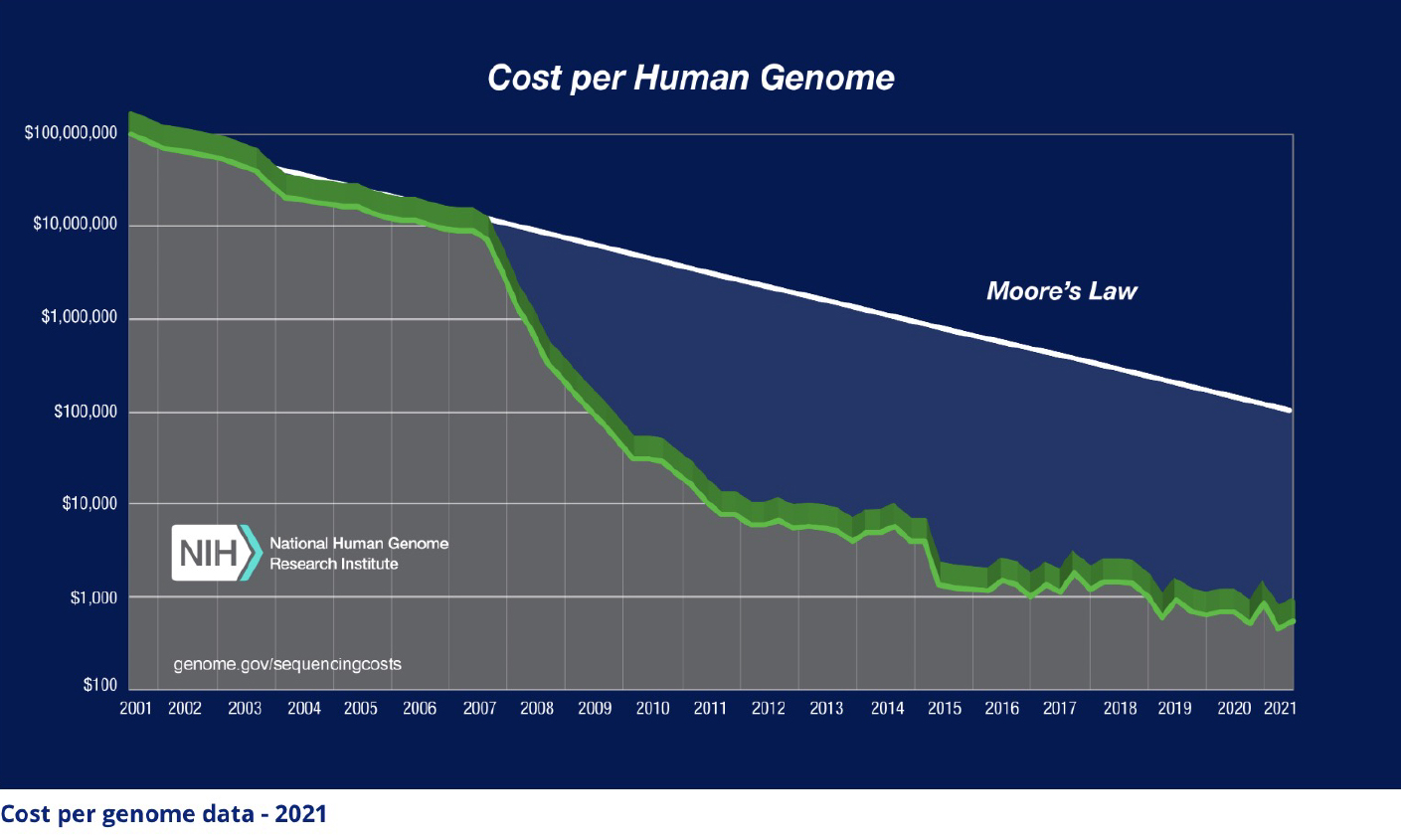

As we saw in our Geno example, industrial biology companies who’ve reached commercial scale have been able to reach at the very minimum, cost-parity with incumbents. At First Bight, we believe this is only the beginning. As technology continues to mature, we will unlock the power of biology just like how we have been able to drive the performance of computing. So far the cost of sequencing has declined at a speed that far exceeded the famous Moore’s Law for computing (see chart below). We believe that consumer appetite for bio-processed goods will sky-rocket as these costs continue to fall.

In addition to technology evolution, increased capacity for bio-manufacturing infrastructure is of paramount importance. Capacity of this magnitude will require mass infrastructure development. Infrastructure and research subsidies have been offered by governments around the world especially in European countries⁵, India⁶, and China⁷. In the last six months, we’ve seen a recognition of the strategic relevance of the bioeconomy for the US and its efforts to maintain its leadership in innovation and dominance in the world economy. To encourage further private participation and investment in this area, the US government has launched a number of initiatives. A prime example of this is President Biden’s executive order on biomanufacturing⁸. This alone allocated $2 billion⁹ for the development of infrastructure and incentives to boost the growth of the domestic bioeconomy. In addition to this, the inflation reduction act (IRA) has allocated more than $500 million¹⁰ for the development of biofuels infrastructure and tax incentives to developers of clean transportation fuels. Funding by the US government will catalyze initial growth and attract more private investment to infrastructure development for biomanufacturing. The magnitude of these combined investments will enable us to break through the bottleneck of biomanufacturing capacity and workforce development, thus accelerating the pace of commercialization for bio-produced products.

Challenges ahead

We mentioned in our first blog that we believe the stars are aligning for the field of industrial biology. Continued technological developments, increasing cost efficiency, escalating consumer interest in bioproducts, along with increased government support and funding, provide a ripe environment for this industry to undergo explosive growth. The best time to enter this market is now. We liken the positioning of industrial biology to that of the semiconductor industry in the 90s. Semiconductors were the backbone that propelled the internet, industrial biology will serve the same function for the bioeconomy which we believe will be just as impactful. Nevertheless, we acknowledge that there are some pieces of the puzzle still missing that need to be established before we reach this point.

In our next blog, we’ll discuss the missing pieces and how capital allocators can help the industry overcome these barriers. Vanquishing these limitations is the key to unlocking the tremendous value creation this industry can bring to our world.

References:

- First Insight consumer report: https://www.firstinsight.com/hubfs/docs/The-Sustainability-Disconnect-Between%20Consumers-and-Retail-Executives-2022.pdf?utm_campaign=The%20State%20of%20Consumer%20Spending&utm_medium=email&_hsmi=200921549&_hsenc=p2ANqtz-_L7cgkDhP7XaKsFXsQUBMVS63zI7ME6wQtLkSsbVlMdwugsuIoETyT22hdhQ9r4FNNOFcUm2cEJobEwqXcHKc-IP0TGA&utm_content=200921549&utm_source=hs_automation

- McKinsey & Co. – EU sustainable spending report: https://www.mckinsey.com/industries/retail/our-insights/the-path-forward-for-sustainability-in-european-grocery-retail

- UN net-zero coalition: https://www.un.org/en/climatechange/net-zero-coalition#:~:text=Currently%2C%20the%20Earth%20is%20already,reach%20net%20zero%20by%202050.

- Geno bioengineering platform: https://www.genomatica.com/wp-content/uploads/2017/01/CEP-Magazine-A-bioengineering-platform-to-industrialize-biotechnology.pdf

- 2022 EU bioeconomy strategy report: https://op.europa.eu/en/publication-detail/-/publication/ae0a36d3-eac3-11ec-a534-01aa75ed71a1

- Government of India biotechnology development strategy: https://dbtindia.gov.in/sites/default/files/NATIONAL%20BIOTECHNOLOGY%20DEVELOPMENT%20STRATEGY_01.04.pdf

- McKinsey & Co. – How can China impact the biopharma industry: https://www.mckinsey.com/~/media/mckinsey/industries/life%20sciences/our%20insights/vision%202028%20how%20china%20could%20impact%20the%20global%20biopharma%20industry/vision-2028-how-china-could-impact-the-global-biopharma-industry.pdf

- Biden’s executive order on biomanufacturing: https://www.whitehouse.gov/briefing-room/presidential-actions/2022/09/12/executive-order-on-advancing-biotechnology-and-biomanufacturing-innovation-for-a-sustainable-safe-and-secure-american-bioeconomy/

- Executive order fact sheet: https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/14/fact-sheet-the-united-states-announces-new-investments-and-resources-to-advance-president-bidens-national-biotechnology-and-biomanufacturing-initiative/

- What the IRA means for biofuels: https://guidehouseinsights.com/news-and-views/what-the-inflation-reduction-act-means-for-biofuels

- NIH cost per human genome: https://www.genome.gov/about-genomics/fact-sheets/Sequencing-Human-Genome-cost

Recent Comments