Contributing Editors: J. Boen and A. Breckenridge

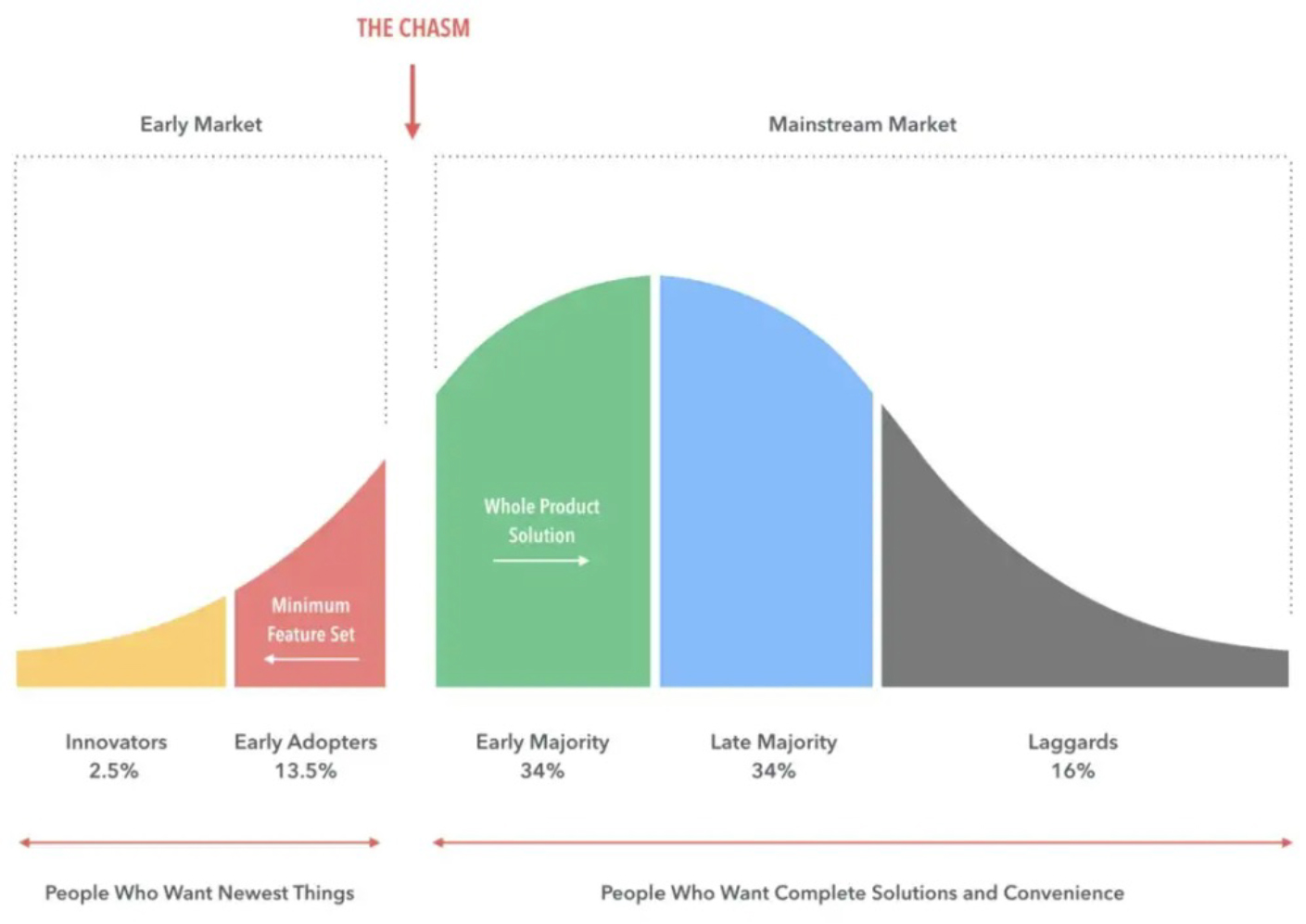

“Crossing the chasm” for Industrial Biology

While the market disruption and sustainability that industrial biology promises to deliver is an alluring goal, it has also been elusive. The industry confronts real challenges to reach mass market success and growth, also known as “the chasm”, which is famously highlighted by Geoffrey Moore in his bestselling book for new technology adoption (see visual below). The enthusiasm of the early adopters and technical developments have not been sufficient to create the “early majority” that the industry had hoped to achieve. In fact, it has been littered with many high-profile failures. A recent example would be Zymergen and their polyimide film¹. Founded in 2013, the company was donned as a leader in the synthetic biology space for many years and received more than a billion dollars in private funding before their IPO in early 2021. The company went public with the proposition that its polyimide film would be a hit as a material in the electronics industry and it would be able to establish a market for a largely unestablished product. Within a few months following their IPO, customers of Zymergen’s polyimide film were displeased with the product’s performance and claimed that there were major issues with its integration into existing manufacturing processes², essentially making the product unusable. Since Zymergen had put all of its eggs into this one basket, the company was forced to pivot and failed to do so effectively. Zymergen was subsequently acquired by Ginkgo Bioworks for $300 million in July of 2022³, an order of magnitude lower than the valuation of the company’s IPO as well as cumulative capital the company had received from investors. Zymergen is not alone in its failure but is a potent example of a strategic mistake where speed was favored over technological readiness.

As Sir Winston Churchill is often quoted, “Never let a good crisis go to waste.” At First Bight, we believe it’s key to understand the specific failure points present in today’s commercialization path. With this information, we hope to build a tailored ecosystem that will support the start-ups in this space to increase their chances of overcoming these barriers. In the following text, we share our perspectives on the most pressing challenges industrial biology faces, and hope that this can catalyze a dialogue for all parties who are interested in supporting the growth of the industry.

Go-To-Market (GTM) path

Commercialization is at the core for every business’ success. Choosing the correct strategy for market entrance can be pivotal in determining the fate of a business, especially in a nascent market like industrial biology. GTM approaches can make or break companies of all sizes, just as the industry and market learned from Zymergen. The strategy a company takes embodies a variety of factors. Some examples of these are: what market a company decides to enter, where a company builds/leases its facility, how accessible are feedstocks and equipment (will dictate answer to previous consideration), what talent is hired, and how capital is managed by the executive team to hedge against risks (single product or multi-product approach). Over the last few decades, globalization practices have pushed many U.S. brands to remove their domestic manufacturing and outsource it to emerging markets⁴. Mainly to seek reduction in labor and facility costs that can increase margins. Unfortunately for industrial biology companies, simple cost arbitrage will only get a business so far as access to feedstocks is vital to production processes⁵. The feedstock is the fuel to production and will largely guide where a company lands geographically to build a facility. On the product strategy front, many industrial biology companies have focused on development of high-value molecules since they have favorable economics at smaller scales. This enables companies to avoid the pressures of being beholden to economies of scale and reach profitability sooner than low-value chemical producers who need massive scale to make the economics work. However, this has greatly limited the potential applications, value creation as well as sustainability impacts that investors had hoped for.

Industrial processes and practice for scaling

To date, most bioproducts have been unable to reach capacities of great magnitude, mainly as a result of insufficient infrastructure. As more biomanufacturing facilities come online, companies will still be faced with the inevitability of technology shortcomings stemming from increasing capacities across the four scales (laboratory, pilot, demo, and commercial). For example, it’s been known that in large-scale continuous fermentation processes, genetic heterogeneity at the cellular level has been a major issue for bioproduct production efforts⁶. In this example, genetic heterogeneity describes how cell populations engineered to be under great metabolic stress for production purposes will begin to select “underperforming” cohorts in the population. These underperforming cells are objectively under less stress than the top performers and therefore can live a “better” life from an evolutionary perspective. This encourages the selection of underperformer phenotype and severely hinders productivity and yield expectations. This can be deleterious to a company’s efforts as they rely on the top performers to maintain steady production of their desired products. In addition to technological barriers, design for biomanufacturing principles will need to be implemented to enable nimble product development and consistent quality for large scale biomanufacturing⁷. Several advancements must occur in order to achieve scaling. Without robust modeling and simulation capabilities to support the design-build-test-learn process, scaling will continue to be an expensive and time-consuming endeavor.

Talent and workforce development

Full commercialization of industrial biology requires integration of multidisciplinary talents such as chemists, biologists, engineers, and computer scientists. Given the broad range of talent needed, many start-ups and large companies struggle to find qualified candidates that can satisfy their multidisciplinary needs. Not only does this require a diverse and broad range of skills, but also individuals who are willing to work as a team that can effectively collaborate and execute across these multiple disciplines. In addition, as companies scale production, they will require trained operators and technicians skilled to maintain and operate biomanufacturing facilities. This will demand the development of curriculums to educate and transition talent to effectively participate in this nascent workforce.

Infrastructure investment

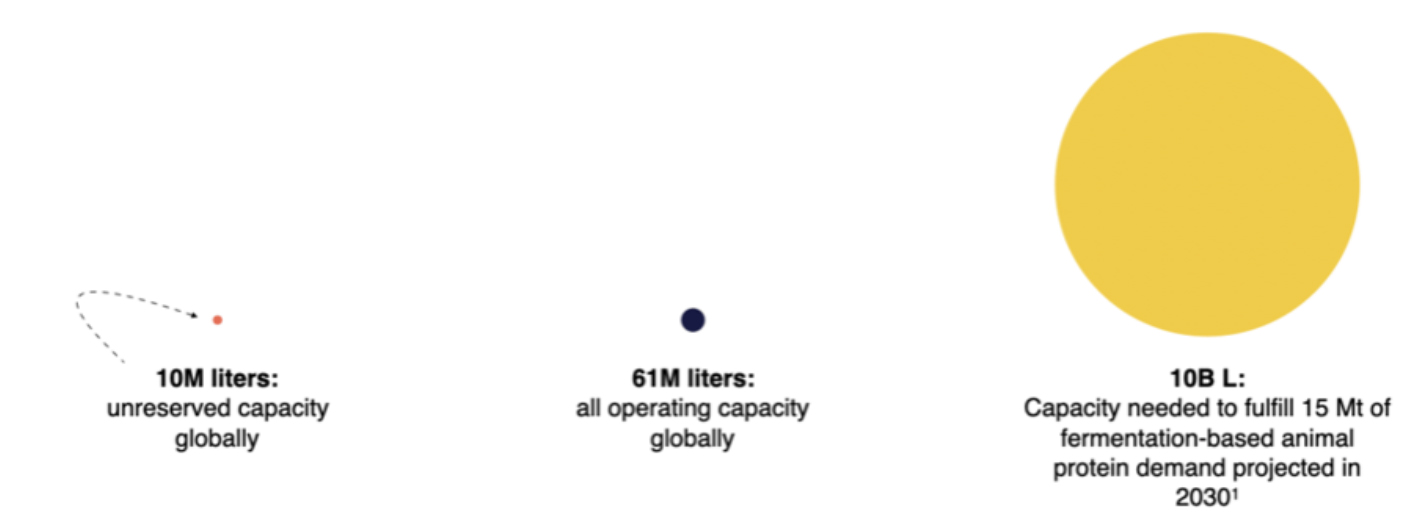

Developing the infrastructure to build and produce bioproducts to meet our global needs will require enormous capital investment. If we were to analogize the requirements for biomanufacturing infrastructure to the existing petrochemical manufacturing, a severe facility deficiency needs to be resolved for bioproducts to enable this transition. As of 2021, there were 61 million liters of bioreactor capacity available across the globe⁸. Of which, 10 million liters were unreserved and only 2 million liters were considered to be food-grade. In the same year, BCG Consulting released an alternative protein report⁹ stating that they project microbes will be able to produce 15 megatons of animal protein by 2030, requiring over 10 billion liters in bioreactor capacity. Quite a farfetched thought if we were to compare this need to the small infrastructure we have available to us today (see visual below). As a result, processes for large-scale bioproduct production haven’t been optimized and facilities to support these processes are sparsely available for young industrial biology companies.

How can companies overcome them?

While these challenges appear quite daunting, we believe that identifying and addressing each individually will enable higher probability of success for startups. In the next series of blogs, we will address each of these challenges separately and highlight some effective strategies and best practices for handling them.

References

- Zymergen polyimide film announcement: https://www.zymergen.com/all-products-and-initiatives/electronics/hyaline-polyimide-film-for-electronics-the-most-exciting-thing-you-can-barely-see/

- Zymergen product complaints and financial repercussions: https://www.icis.com/explore/resources/news/2021/08/04/10670574/stock-of-us-biotech-firm-zymergen-falls-76-on-product-sales-warning/

- Zymergen sale to Ginkgo Bioworks: https://www.fiercebiotech.com/biotech/seven-months-after-announcing-pivot-drug-discovery-zymergen-acquired-ginkgo

- Offshore manufacturing: https://marketbusinessnews.com/financial-glossary/offshore-manufacturing/#:~:text=Offshore%20manufacturing%20refers%20to%20relocating,the%20other%20country%20are%20cheap

- BCG “Synthetic Biology Is About to Disrupt Your Industry”: https://www.bcg.com/publications/2022/synthetic-biology-is-about-to-disrupt-your-industry

- Diverse genetic error modes constrain large-scale bio-based production: https://www.nature.com/articles/s41467-018-03232-w

- BioMADE bioindustrial manufacturing technical roadmap: https://static1.squarespace.com/static/61d9c20c46d51b49b50f6229/t/6256d90ebca70851f5f3a662/1649858848790/BioMADE+Transition+Technical+Roadmap.pdf

- The Biomanufacturing Capacity Problem: https://blog.culturebiosciences.com/global-biomanufacturing-capacity-problem

- BCG Alternative Protein Report: https://www.bcg.com/en-us/publications/2021/the-benefits-of-plant-based-meats

Recent Comments