Contributing Editors: J. Boen and A. Breckenridge

Significant Capital Expenditure (CapEx) required to scale

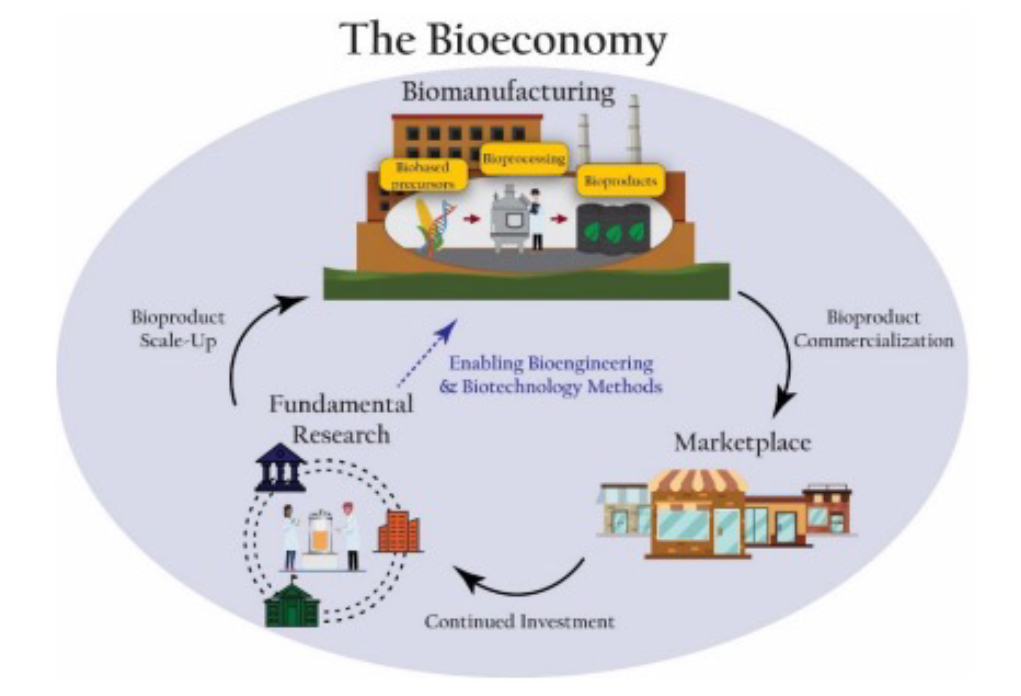

Establishing biomanufacturing capacity and developing its workforce have been highlighted in the most recent PCAST report¹ as the biggest gaps in the growth of the bioeconomy. Scaling biomanufacturing is a time-consuming and capital-intensive process. Things like equipment² and talent³ are notable, capital-heavy necessities when bringing bioproduction to scale. Infrastructure for scaling is currently a key bottleneck in the US⁴. America faces the potential of losing competitive advantage as companies look overseas, especially to Asia and China, similar to the semiconductor industry. Federal funding to support establishing biomanufacturing infrastructure hubs across America is recommended by PCAST. Recent initiatives around biomanufacturing infrastructure development like the $1 billion allocation⁵ the Department of Defense (DoD) received and other infrastructure funding will catalyze systemic growth on this front. However, scaling will also require CapEx to fund bioprocess optimization efforts given that lab-scale work doesn’t always translate when moved to large-scale production. Bioprocess scale-up is inherently complex⁶ and requires a steady duration of testing to reach full optimization. The value that can be derived from data at the pilot scale cannot be understated. Developing standards, metrics, and quality consistency across these processes that can be applied industry-wide will a) allow startups to optimize production and b) enhance the likelihood of success thus attracting more capital. These are complex issues that will likely require coordinated efforts across industry, regulatory bodies, research institutions, and long-term capital.

Private capital begins to open more financing options

Industrial biology companies traditionally had limited options to obtain financing. Non-dilutive research and federal grants have been the key sources. We are seeing increased investment in climate and sustainability projects through vehicles such as SBIR/STTR funding, government agencies funding research (NSF, DoE, USDA, etc.), and even philanthropic foundations such as Schmidt Futures who have shown great interest⁷ in the bioeconomy’s development. Venture capital has mostly strayed away from the daunting CapEx investment required to scale bioproduction. Conversely, we’ve begun to see an increasing interest from long-term capital allocators who’ve recognized the potential of the industry. They are starting to offer leasing options for equipment as well as biomanufacturing facilities. Additionally, we are seeing growth in vertically focused CMOs/CDMOs (e.g. Planetary, Liberation Labs, etc.) that allow startups to outsource production to minimize short-term CapEx. For example, Liberation Labs just raised a $20 million seed round in December of 2022 to build its commercial-scale facility (600,000 L of capacity) for developers in the alternative protein space⁸. Even technical service providers like Ginkgo Bioworks are beginning to offer increased in-house capacity⁹ to its customers which will also help minimize the risk associated with acquiring equipment and facilities (though this is an inevitability if the technology succeeds).

Biomanufacturing talent and workforce needed

As we highlighted in our last blog, talent is a vital resource for industrial biology startups. Especially as these companies emerge from the laboratory where the necessary skill set changes to more heavily rely on manufacturing and business expertise. Given the nascence of biomanufacturing, there is limited existing skilled talent. These skill sets are well sought after and come with a hefty price tag. We believe that the current economic environment may act as a catalyst for talent from adjacent industries to migrate to this nascent area of innovation. Furthermore, as workforce development processes are established, this will increasingly support the future growth of the talent pool that’s available to the bioeconomy.

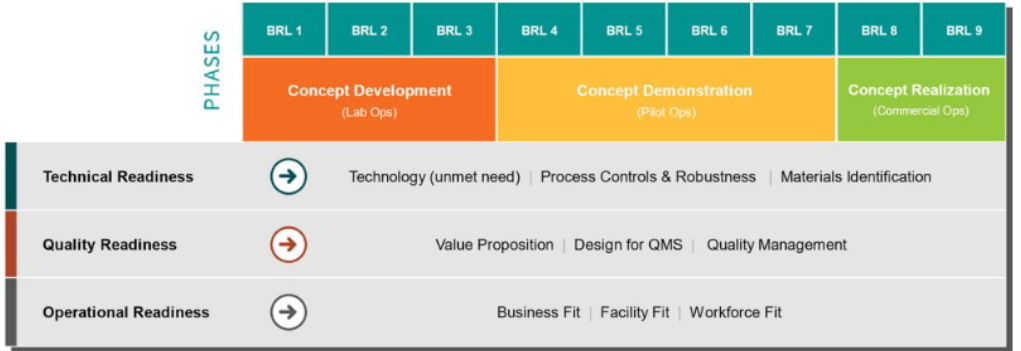

Achieving pilot production unlocks new opportunities

Inherently, investors favor companies who have pilot-scale production data as it more closely resembles the efficacy of the production process to meet the end goal of commercialization. The more startups can show high-value data to support the scaling of bioproduction, the more they can leverage capital other than just their equity to support their growth. Biomanufacturing readiness levels (BRLs) 4-7 is where most startups fail. Getting more startups to pilot-scale is the key to unlocking capital and enabling more success moving forward.

Looking ahead

As we’ve highlighted throughout this writing, scaling bioproduction is not a trivial feat. It requires the conjoinment of many external factors (e.g. capital, talent acquisition, etc.) along with the innate complexities of engineering a biological system to work at scale. While there is still progress to be made on both of these topics, we believe that the light at the end of the tunnel is near. At First Bight, we believe the answer lies in architecting a public-private partnership that addresses these issues by providing innovators access to infrastructure for scaling, talent, and investment.

References

- PCAST Biomanufacturing Report – December 2022: (https://www.whitehouse.gov/wp-content/uploads/2022/12/PCAST_Biomanufacturing-Report_Dec2022.pdf)

- Techno-economic model of commercial scale fermentation platform: (https://biotechnologyforbiofuels.biomedcentral.com/articles/10.1186/s13068-021-01911-3/tables/3)

- CBRE Life Sciences Research Talent Report 2022: (https://www.cbre.com/insights/reports/us-life-sciences-talent-2022)

- The Biomanufacturing Capacity Problem: (https://blog.culturebiosciences.com/global-biomanufacturing-capacity-problem)

- Department of Defense – Executive order funding allocation (https://www.defense.gov/News/Releases/Release/Article/3157504/new-biotechnology-executive-order-will-advance-dod-biotechnology-initiatives-fo/)

- Difficulties of scaling industrial biotechnology: (https://www.biofuelsdigest.com/bdigest/2015/12/02/what-makes-scale-up-of-industrial-biotechnology-so-difficult/)

- Schmidt Futures: The U.S. Bioeconomy Strategy Report: (https://www.schmidtfutures.com/wp-content/uploads/2022/04/Bioeconomy-Task-Force-Strategy-4.14.22.pdf)

- Liberation Labs $20 million seed round: (https://www.globenewswire.com/news-release/2022/12/30/2581039/0/en/Liberation-Labs-Announces-Final-Close-of-20-Million-in-Seed-Financing.html)

- Ginkgo Bioworks Expands R&D Facilities: (https://www.contractpharma.com/contents/view_breaking-news/2023-01-09/ginkgo-bioworks-expands-rd-facilities-with-opening-of-bioworks7/)

Recent Comments